Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

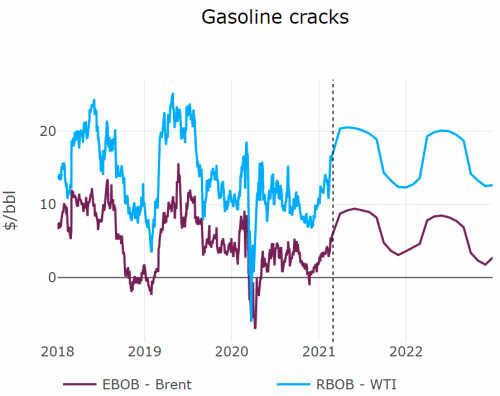

Brent prompt future contract partially recovered from Friday’s sell-off, at 65.6 $/b, as the Iranian nuclear deal seemed in jeopardy after the Iranian refusal to join the talks organized by the Europeans. Furthermore, High US products cracks are incentivizing US refineries to ramp-up their secondary units swiftly. Lower US naphtha supply also had effects on Asian naphtha markets, with cracks hiking significantly. However, Chinese crude imports look increasingly soft, as prices for West African cargoes are showing signs of weakness. Finally, the $1.9 trillion US stimulus package is close to approval and would materially boost US employment, a key factor for gasoline consumption.

Get more analysis and data with our Premium subscription

Ask for a free trial here