Mixed sentiment on financial markets

Mixed sentiment on financial markets to start this week. US equities ended last week at record-high levels but volatility was high after a big family…

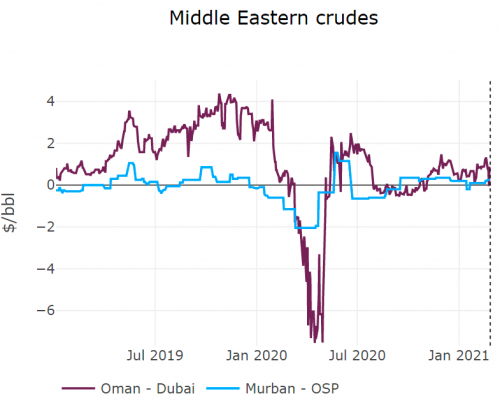

Brent prompt future contract came back to 66.2 $/b as a significant selloff in the US bond market strengthened the dollar, pushing dollar-denominated commodities lower. Product cracks consolidated at elevated levels as refiners announced that their return to the market could be in early March. Chinese crude buying will likely ease in the coming month as refiners enter a period of turnarounds, physical cargoes to Asia reflected the softness in Chinese demand.

Get more analysis and data with our Premium subscription

Ask for a free trial here