Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Optimism was back with a vengeance on markets yesterday and the trend was confirmed in Asia overnight: stocks on the rise despite bond yields reaching new highs, higher commodity prices with the exception of safe-haven assets such as gold, lower USD, the EUR/USD nearing 1.22. The reasons are well known: recovery expectations reinforced by prospects of a first vote of the US stimulus package by the House tomorrow and confirmation by Jerome Powell that the Fed has yet no intention to tighten its policy.

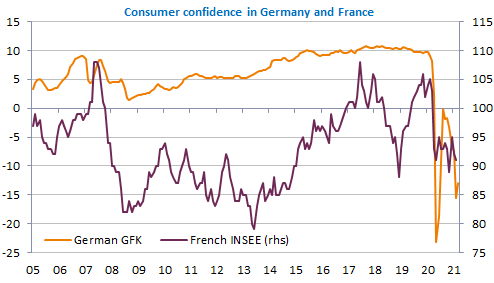

Consumer confidence rebounded for the 1st time since August in Germany (baring a marginal increase in October) but remained low nevertheless. In France, consumer confidence deteriorated further in line with gloomy news about the pandemic and the never-ending lockdown measures, now taken at local level.

Get more analysis and data with our Premium subscription

Ask for a free trial here