Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

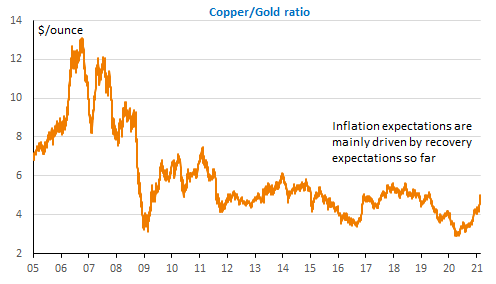

The Nasdaq lost 2.5% yesterday for a cumulated loss of 4% since the start of last week. Inflation worries and the rise in bond yields are the main culprit, even if they are mainly linked to recovery prospects so far, as shown by the sharp rebound in the copper to gold ratio. The UK Prime Minister unveiled yesterday a four-month plan to definitely exit from the Covid crisis. This is good news, but seen from continental Europe where the vaccination campaign is considerably lagging behind, this means the comeback to normal is still likely a long, long way off. The USD has weakened a bit ahead of the Fed Chief’s testimony in front of the banking commission of the Senate today and the EUR/USD is trading near 1.2175.

Get more analysis and data with our Premium subscription

Ask for a free trial here