The winter of diesels

Diesel stockpiles globally continue to be the focus of many market participants, as ARA stocks were depleted last week by 1.4 mb, while Singapore and…

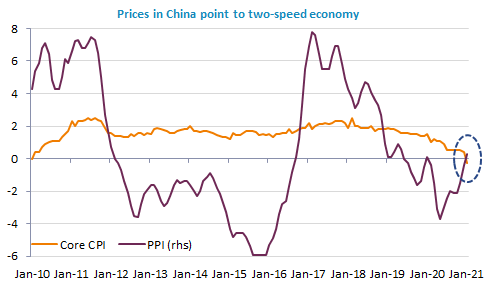

The rally in US stocks was interrupted yesterday, mainly on inflation fears that have been strengthening significantly since Joe Biden unveiled his $1.9tn stimulus plan. The key question is whether the rise in inflation that should accompany the recovery is strong enough to push bond yields sharply higher, destabilize financial markets and trigger a U-turn in central banks’ policy, especially the Fed. Nobody has the answer today. So this question will remain the main focus of financial markets in the coming months and probably beyond. The EUR/USD pursues its rebound and is now trading around 1.2125.

Get more analysis and data with our Premium subscription

Ask for a free trial here