Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

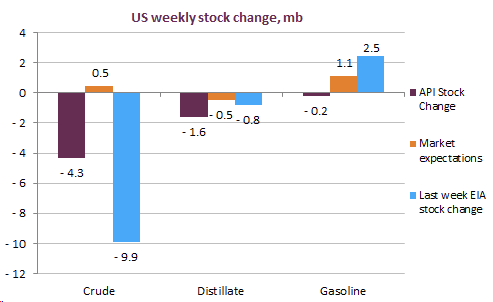

Brent prompt futures continued to rally to 54.7 $/b on early Thursday as Saudi Arabia guaranteed that their voluntary supply cut would last two months starting in February. The US weekly report reported rising refining runs leading to a large stocks draw of 8 mb. On the product side, US oil product markets weakened. Overall implied demand plummeted by 2.26 mb/d w/w. The recovery in Japanese runs halted, according to PAJ data, to 2.7 mb/d, as Japan wrestle with a hike in coronavirus cases. Finally, Canadian crude production has been ramping-up lately following November’s price rally as oil sands production in the Alberta region resumes.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!