Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

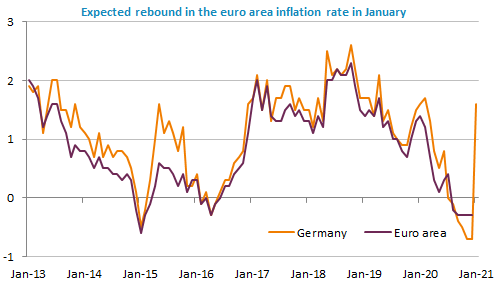

Whatever the reason, the same story repeats again and again: each downward correction on financial markets is seen as a buying opportunity by many. This is mainly linked to abundant liquidity. Economic fundamentals have little to do with this behaviour and the fact that markets completely ignored rather bad Chinese economic indicators released overnight just confirmed that. The EUR/USD touched a new 2-month low, just above 1.20 yesterday, as the euro area cumulates economic and political worries. It rebounded just after Mario Draghi, the former ECB chief, was summoned by the Italian President to attempt forming a government. Services PMI, the ADP job report on private employment and a rebound in the euro area inflation rate are on the agenda today.

Get more analysis and data with our Premium subscription

Ask for a free trial here