Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices faded yesterday, pressure by expectations of warmer weather and improved French nuclear availability. Prices dropped by 6.08€/MWh to 51.15€/MWh on average in Germany, France, Belgium and the Netherlands.

The French power consumption rose to 63.47GW on average yesterday, +1.42GW from Friday but 9.36GW below the previous week due to the higher temperatures. The nuclear generation rose to 48.69GW and is expected to climb near 49.60GW today. The German wind production strengthened by 2.50GW from Sunday to 10.53GW on average but should slightly ease today.

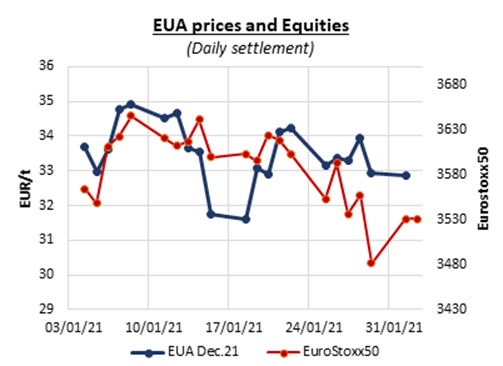

EUA started the day pursuing Friday’s retreat but rebounded and climbed back above 33€/t mid-day, likely supported by the bullish oil and financial markets. The carbon prices however eased at the end of the session as they tracked the losses in the gas market. Monday’s auction cleared with only a slight 0.06€/t discount to the secondary market, much lower than the 0.27€/t difference seen on Friday, but the bid coverage remained weak at 1.45. Several market participants pointed to the resilience of carbon prices to the resumption of the primary market sales so far, possibly supported by the cold weather prospects for next week. Most however agree that this new and heavy supply is likely to limit any upside potential in the upcoming weeks and do not expect EUAs to test their recent all-time high of 35.42€/t without a real cold spell in February.

The bearish gas prices pressured the power forward market which extended losses along the curve yesterday.

Get more analysis and data with our Premium subscription

Ask for a free trial here