Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices for today climbed back above the clean gas and coal costs, lifted by forecasts of a weak renewable production and lower temperatures (although increasing) temperatures.

Prices hence reached 57.23€/MWh on average in Germany, France, Belgium and the Netherlands, +8.39€/MWh from Friday.

The temperatures nearly 6°C above normal curbed the French power consumption on Friday which faded by 3.73GW to 62.05GW on average. The nuclear generation waned as well to reach 46.27GW, -2.03GW dod. The German wind generation however temporary surged to average 23.39GW, +11.63GW from Thursday, but quickly eased below 10GW over the weekend.

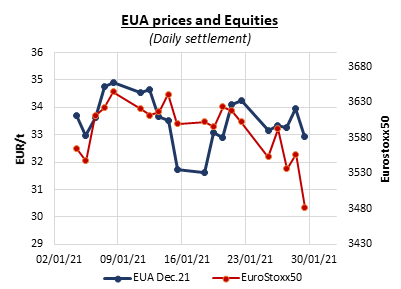

EUAs fell by 1.00€/t over the last session of the week, mainly weighed by the auction resumption with additional pressure from the weaker energy complex and fading equities. The German spot auction, the first sale of the fourth phase of the EU ETS, cleared with a hefty 0.27€/t discount to the secondary market and a weak 1.59 cover ratio (to compare with, the bid coverage averaged 1.76 in 2020), which pushed carbon prices down throughout the day. This year’s sales are however particular since compliance companies will not be allowed to surrender Phase 4 allowances (bought through auctions or allocated from 2021) for their emissions of 2020 in April. As a consequence, the market’s two exchanges ICE and EEX introduced on Friday independent futures for Phase 4 allowances which will be traded in parallel of the phase 3 contracts until April.

Get more analysis and data with our Premium subscription

Ask for a free trial here